Payment of Filing Fee (Check the appropriate box): x | | No fee required | | | | X.¨

| No fee required.

| | | | .

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | | | | | | | | (1) | | Title of each class of securities to which transaction applies: | | | | | | | | (2) | | Aggregate number of securities to which transaction applies: | | | | | | | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0–110-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | | | | | | | | (4) | | Proposed maximum aggregate value of transaction: | | | | | | | | (5) | | Total fee paid: | | | | | | .¨

| | Fee paid previously with preliminary materials.materials: | | | | .¨

| | Check box if any part of the fee is offset as provided by Exchange Act Rule 0–11(a)0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | | | | | | | | (1) | | Amount Previously Paid:previously paid: | | | | | | | | (2) | | Form, Schedule or Registration Statement No.: | | | | | | | | (3) | | Filing Party: | | | | | | | | (4) | | Date Filed: | | | | | |

WIZE PHARMA, INC.

![[def14a071513_def14a001.jpg]](https://capedge.com/proxy/DEF 14A/0001078782-13-001349/def14a071513_def14a001.jpg)

10 Bareket StreetIsrael 4527708

Petach Tikva, Israel 4951778Telephone: +(972) 72-260-0536

+(972) 3-9241114

NOTICE OF SOLICITATIONSPECIAL MEETING OF CONSENTSSTOCKHOLDERS

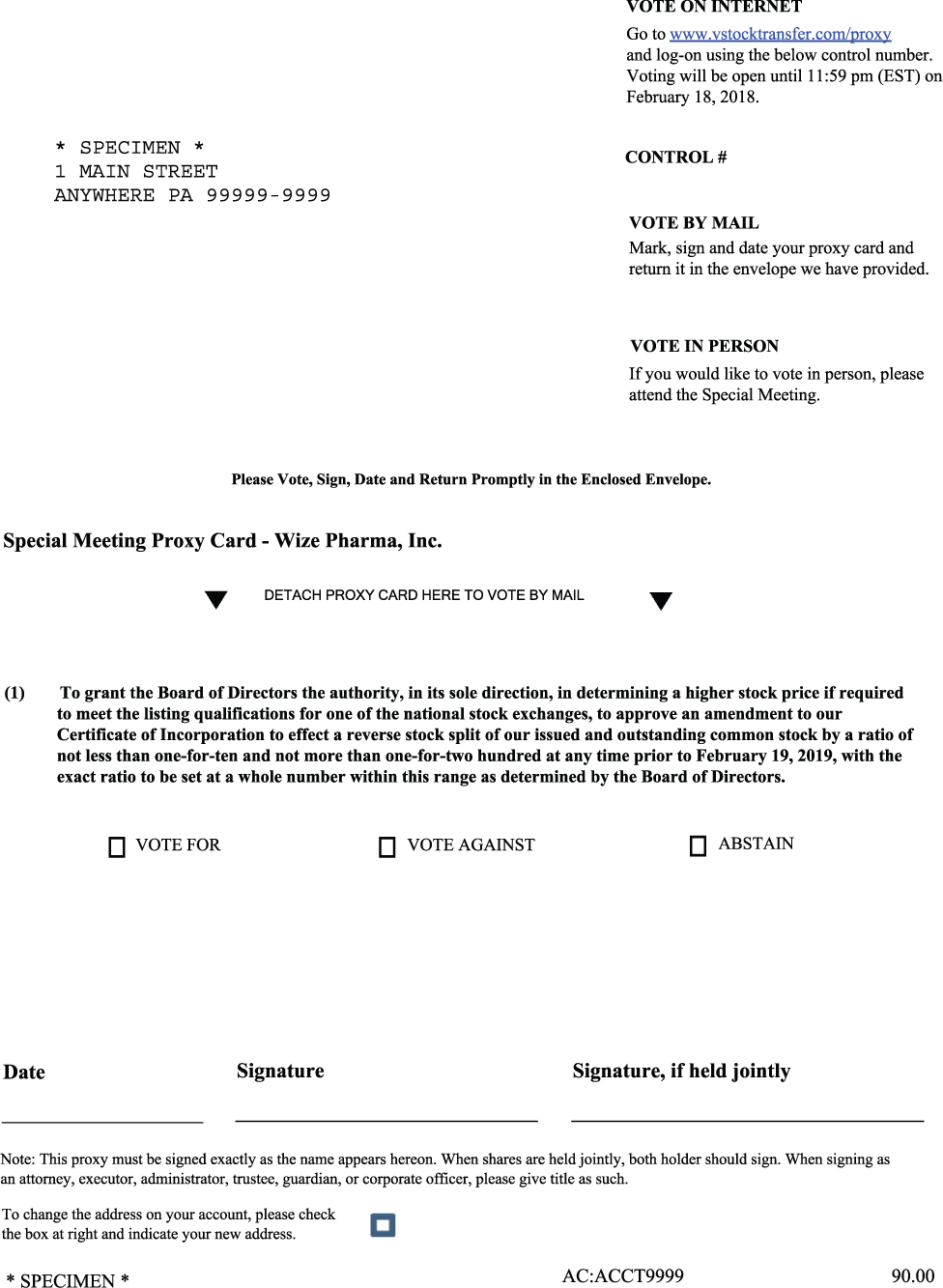

The special meeting (“Special Meeting”) of the stockholders of Wize Pharma, Inc. (the “Company”) will be held on February 19, 2018, at 10:00 a.m. local time at the law offices of Goldfarb Seligman & Co., 98 Yigal Alon St., Tel Aviv, Israel for the purposes of considering the following proposals:

July 15, 2013

TO OUR STOCKHOLDERS:

This Notice of Solicitation of Consents and accompanying Consent Solicitation Statement are furnished to you by OphthaliX Inc., a Delaware corporation (the “Company” or “us” or “we” or “our”) in connection with1. To grant the solicitation on behalf of our Board of Directors the authority, in its sole direction, to approve an amendment to our Certificate of written consents from the holders of the Company’s Common Stock (the “Stockholders”)Incorporation to take action without a stockholders’ meeting.

Our Board of Directors is requesting the Stockholders to consent to the following proposal:

·

To effect a reverse stock split of one share for each fourour issued and one-half shares outstanding (1:4.5), whereby,common stock by a ratio of not less than one-for-ten and not more than one-for-two hundred at any time prior to February 19, 2019, with the exact ratio to be set at a whole number within this range as determined by the Board of the Record Date (as defined below), for every four and one-half sharesDirectors.

Only stockholders of Common Stock then owned, each holderrecord of Common Stock shall receive one share of Common Stock.

We have establishedour common stock at the close of business on July 5, 2013, asJanuary 30, 2018 will be entitled to attend and vote at the record date (the “Record Date”) for determiningmeeting. A list of all stockholders entitled to submit written consents.

We request thatvote at the Special Meeting will be available at the principal office of the Company for the ten days prior to February 19, 2018. The list will be arranged in alphabetical order and show the address and number of shares held by each stockholder. It will be available for examination by any stockholder complete, date and sign the enclosed written consent form and promptly return it the Company’s legal counsel by mail at 1656 Reunion Avenue, Suite 250, South Jordan, Utah 84095, by email at jamie@vancelaw.us, or by fax at (801) 446-8803. To be counted, your properly completed written consent must be received before 5:00 p.m. Mountain Time, on July 31, 2013, subject to extension by our Board of Directors or to early termination of solicitations if a majority approval is received.

Failure to return the enclosed written consent will have the same effect as a vote against the proposal. We recommend that all stockholders consentfor any purpose germane to the proposal, by marking the box entitled “FOR” with respect to the proposal on the enclosed written consent form, and sending the written consent to us. If you sign and send in the written consent form but do not indicate how you want to vote as to the proposal, your consent formSpecial Meeting. The proxy materials will be treated as a consent “FOR” the proposal.

Consents may be revoked bymailed to stockholders at any time before the time that we receive and accept the written consents of the Stockholders representing a majority of shares entitled to vote.on or about February 5, 2018.

By Order of the Board of Directors

/s/Ron Mayron

Chairman

WHETHER OR NOT YOU PLAN ON ATTENDING THE SPECIAL MEETING IN PERSON, PLEASE VOTE AS PROMPTLY AS POSSIBLE TO ENSURE THAT YOUR VOTE IS COUNTED.

/s/ Barak Singer

Barak SingerWIZE PHARMA, INC.

5b Hanagar Street, Hod Hasharon Israel 4527708 Telephone: +(972) 72-260-0536 PROXY STATEMENT SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON FEBRUARY 19, 2018 SOLICITATION OF PROXIES The enclosed proxy is solicited by the Board of Directors of Wize Pharma, Inc. (referred to as the “Company”, “we,” “us,” or “our”) for use at the Special Meeting of the Company’s stockholders to be held at the law offices of Goldfarb Seligman & Co., 98 Yigal Alon St., Tel Aviv, Israel on February 19, 2018 at 10:00 a.m. local time and at any adjournments thereof. Whether or not you expect to attend the Special Meeting in person, please vote your shares as promptly as possible to ensure that your vote is counted. The proxy materials will be mailed to stockholders on or about February 5, 2018. REVOCABILITY OF PROXY AND SOLICITATION Any stockholder executing a proxy that is solicited hereby has the power to revoke it prior to the voting of the proxy. Revocation may be made by attending the Special Meeting and voting the shares of stock in person, or by delivering to the Secretary of the Company at the principal office of the Company prior to the Special Meeting a written notice of revocation or a later-dated, properly executed proxy. Solicitation of proxies may be made by directors, officers and other employees of the Company by personal interview, telephone, facsimile transmittal or electronic communications. No additional compensation will be paid for any such services. This solicitation of proxies is being made by the Company which will bear all costs associated with the mailing of this proxy statement and the solicitation of proxies. RECORD DATE Holders of record of our common stock at the close of business on January 30, 2018 will be entitled to receive notice of, to attend and to vote at the Special Meeting. ACTION TO BE TAKEN UNDER PROXY Unless otherwise directed by the giver of the proxy, the persons named in the form of proxy, namely, Or Eisenberg, our Acting Chief Executive Officer, Chief Financial Officer, Treasurer and Secretary, and Noam Danenberg, our Chief Operating Officer, or either one of them who acts, will vote:

• FOR granting the Board of Directors the authority, in its sole direction, to approve an amendment to our Certificate of Incorporation to effect a reverse stock split (the “Reverse Stock Split”) of our issued and outstanding common stock by a ratio of not less than one-for-ten and not more than one-for-two hundred at any time prior to February 19, 2019, with the exact ratio to be set at a whole number within this range as determined by the Board of Directors; and

![[def14a071513_def14a002.jpg]](https://capedge.com/proxy/DEF 14A/0001078782-13-001349/def14a071513_def14a002.jpg)

10 Bareket Street1

Petach Tikva, Israel 4951778WHO IS ENTITLED TO VOTE; VOTE REQUIRED; QUORUM

+(972) 3-9241114As of January 30, 2018, the record date, there were 104,412,510 shares of common stock issued and outstanding, which constitutes all of the outstanding capital stock of the Company. Holders of common stock are entitled to one vote for each share of common stock held by them.

33.33% of the 104,412,510 outstanding shares of capital stock, present in person or represented by proxy, will constitute a quorum at the Special Meeting. For purposes of the quorum and the discussion below regarding the vote necessary to take stockholder action, stockholders of record who are present at the Special Meeting in person or by proxy and who abstain, including brokers holding customers’ shares of record who cause abstentions to be recorded at the Special Meeting, are considered stockholders who are present and entitled to vote and are counted towards the quorum. Only stockholders of record at the close of business on January 30, 2018 are entitled to receive notice of, to attend, and to vote at the Special Meeting. Information about the stockholdings of our directors and executive officers is contained in the section of this proxy statement entitled “Security Ownership of Certain Beneficial Owners and Management.” Pursuant to the Company Bylaws, if a quorum fails to attend the Special Meeting, the chair of the Special Meeting may adjourn the Special Meeting to another place, date, and time.

CONSENT SOLICITATION STATEMENTBrokers holding shares of record for customers generally are not entitled to vote on “non-routine” matters, unless they receive voting instructions from their customers. As used herein, “uninstructed shares” means shares held by a broker who has not received voting instructions from its customers on a specific proposal. A “broker non-vote” occurs when a nominee holding uninstructed shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that non-routine matter. In connection with the treatment of abstentions and broker non-votes, the approval of the Reverse Stock Split (Proposal 1) is considered a non-routine matter. Accordingly, brokers are not entitled to vote uninstructed shares with respect to Proposal No. 1.

We strongly encourage you to provide voting instructions to brokers holding shares in order to ensure your shares will be voted at the Special Meeting in the manner you desire.

General2

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS

This Consent Solicitation Statement is being furnishedWhy am I receiving these materials?

Wize Pharma, Inc. has made these materials available to you in connection with the Company’s solicitation of written consentsproxies for use at the Special Meeting of stockholders to be held on February 19, 2018 at 10:00 a.m. local time at the law offices of Goldfarb Seligman & Co., 98 Yigal Alon St., Tel Aviv, Israel. These materials describe the proposals on which the Company would like you to vote and also give you information on these proposals so that you can make an informed decision. We are mailing our proxy materials on or about February 5, 2018 to all stockholders of OphthaliX Inc.,record entitled to vote at the Special Meeting. What is included in these materials? These materials include this proxy statement, the proxy card or the voter instruction form for the Special Meeting. What is the proxy card? The proxy card enables you to appoint Or Eisenberg, our Acting Chief Executive Officer, Chief Financial Officer, Treasurer and Secretary, and Noam Danenberg, our Chief Operating Officer, as your representative at the Special Meeting. By completing and returning a Delaware corporation (the “Company”proxy card, you are authorizing these individuals to vote your shares at the Special Meeting in accordance with your instructions on the proxy card. This way, your shares will be voted whether or “us” or “we” or “our”) with regardnot you attend the Special Meeting. What items will be voted on? You are being asked to vote on the following specific proposal:

·

•To grant the Board of Directors the authority, in its sole direction, to approve an amendment to our Certificate of Incorporation to effect a reverse stock split of one share for fourour issued and one-half shares outstanding (1:4.5), whereby,common stock by a ratio of not less than one-for-ten and not more than one-for-two hundred at any time prior to February 19, 2019, with the exact ratio to be set at a whole number within this range as determined by the Board of Directors. We will also transact any other business that properly comes before the Record Date (as defined below), for every four and one-half sharesSpecial Meeting. How does the Board of Common Stock then owned, each holder of Common Stock shall receive one share of Common Stock.

This Consent Solicitation Statement contains important information for you to consider when deciding how to vote on these matters.Please read it carefully.

Directors recommend that I vote?

Our Board of Directors has approvedunanimously recommends that you vote your shares: • FOR granting the proposalBoard of Directors the authority, in its sole direction, to approve an amendment to our Certificate of Incorporation to effect a reverse stock split of our issued and has chosenoutstanding common stock by a ratio of not less than one-for-ten and not more than one-for-two hundred at any time prior to seekFebruary 19, 2019, with the exact ratio to obtainbe set at a whole number within this range as determined by the Board of Directors. What is the difference between a stockholder approvalof record and a beneficial owner of shares held in street name? Some of our stockholders hold their shares in an account at a brokerage firm, bank or other nominee holder, rather than holding share certificates in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially in street name. Stockholder of Record If on January 30, 2018 your shares were registered directly in your name with our transfer agent, VStock Transfer LLC, you are considered a stockholder of record with respect to those shares, and the proxy materials, including a proxy card, were sent directly to you by the Company. As the stockholder of record, you have the right to direct the voting of your shares by returning the proxy card to us, including voting over the Internet. Whether or not you plan to attend the Special Meeting, if you do not vote over the Internet, please complete, date, sign and return a proxy card to ensure that your vote is counted. 3 Beneficial Owner of Shares Held in Street Name If on January 30, 2018 your shares were held in an account at a brokerage firm, bank, broker-dealer, or other nominee holder, then you are considered the beneficial owner of shares held in “street name,” and the proxy materials, including a voter instruction form, were forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Special Meeting. As the beneficial owner, you have the right to direct that organization on how to vote the shares held in your account. However, since you are not the stockholder of record, you may not vote these shares in person at the Special Meeting unless you receive a valid proxy from the organization. If you request printed copies of the proposalproxy materials by written consent, rather thanmail, you will receive a voter instruction form. How Do I Vote? Stockholders of Record. If you are a stockholder of record, you may vote by callingany of the following methods: •Via the Internet. You may vote by proxy via the Internet by following the instructions provided in the proxy materials. •By Mail. You may vote by completing, signing, dating and returning your proxy card in the pre-addressed, postage-paid envelope provided. •In Person. You may attend and vote at the Special Meeting. The Company will give you a special meetingballot when you arrive. Beneficial Owners of stockholders,Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters, but cannot vote on non-routine matters such as Proposal No. 1. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization that holds your shares will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.”We strongly encourage you to provide voting instructions to brokers holding shares in order to eliminateensure your shares will be voted at the costs and management time involvedSpecial Meeting in holdingthe manner you desire. If you are a special meeting, andbeneficial owner of shares held in order to effect the proposed corporate action as quickly as possible. Written consents are being solicited from all of our stockholders pursuant to Section 228street name, you may vote by any of the General Corporation Law, as amended,following methods: •Via the Internet. You may vote by proxy via the Internet by following the instructions provided in the proxy materials. •By Telephone. You may vote by proxy by calling the toll free number found on the voter instruction form. •By Mail. You may vote by proxy by filling out the voter instruction form and returning it in the pre-addressed, postage-paid envelope provided. •In Person. If you are a beneficial owner of shares held in street name and you wish to vote in person at the State of Delaware (the “DGCL”)Special Meeting, you must obtain a legal proxy from the organization that holds your shares. What if I change my mind after I have voted? You may revoke your proxy and change your vote at any time before the Bylaws offinal vote at the Company, as amended.

Voting materials, which include this Consent Solicitation StatementSpecial Meeting. You may vote again on a later date via the Internet (only your latest Internet proxy submitted prior to the Special Meeting will be counted), by signing and returning a new proxy card or a voter instruction form with a later date, or by attending the Special Meeting and voting in person. However, your attendance at the Special Meeting will not automatically revoke your proxy unless you vote again at the Special Meeting or specifically request that your prior proxy be revoked by delivering to the Company’s Secretary at 5b Hanagar Street, Hod Hasharon, Israel 4527708, a written consent form, are being mailed to all stockholders on or about July 15, 2013. Our Boardnotice of Directors has set the close of business on July 5, 2013, as the record date for the determination of stockholders entitled to act with respectrevocation prior to the consent action (the “Record Date”). On the Record Date the Company had outstanding 46,985,517Special Meeting.

4 Please note, however, that if your shares of Common Stock for 46,985,517 votes which would permit an aggregate of 46,985,517 votes as of the Record Date. In order for the proposals to be approved pursuant to Delaware law, we must receive the written consent of a majority of the outstanding shares of Common Stock (the “Requisite Consents”).

How to Submit Consents; Expiration Date

Stockholdersare held of record who desireby an organization, you must instruct them that you wish to consentchange your vote by following the procedures on the voter instruction form provided to you by the proposal may do so by delivering the applicable written consent to us by hand, mail, email, facsimile or overnight courier, in accordance with the instructions contained in the written consent.organization. If your shares are held in street name, and you wish to attend the Special Meeting and vote at the Special Meeting, you must bring to the Special Meeting a legal proxy from the organization holding your shares, confirming your beneficial ownership of the shares and giving you the right to vote your shares.

How are proxies voted? All valid proxies received prior to the Special Meeting will be voted. All shares represented by a proxy will be voted and, where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the stockholder’s instructions. What happens if I do not give specific voting will dependinstructions? Stockholders of Record. If you are a stockholder of record and you: • indicate when voting on the voting processes of your broker, bank, or other holder of record. Therefore, we recommendInternet that you followwish to vote as recommended by the Board of Directors, or • sign and return a proxy card without giving specific voting instructions, then the proxy holders will vote your shares in the manner recommended by the Board of Directors on all matters presented in this proxy statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Special Meeting. We strongly encourage you to provide voting instructions to ensure your shares will be voted at the Special Meeting in the manner you desire. Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters, but cannot vote on non-routine matters, which includes granting the Board of Directors the authority, in its sole direction, in determining a higher stock price that may be required to meet the listing qualifications for one of the national securities exchanges, to approve the Reverse Stock Split (Proposal 1). Accordingly, brokers are not entitled to vote uninstructed shares with respect to Proposal No. 1.We strongly encourage you to provide voting instructions to brokers holding shares in order to ensure your shares will be voted at the Special Meeting in the manner you desire. Do I have dissenters’ right of appraisal? Holders of shares of our common stock do not have appraisal rights under Delaware Law or under the governing documents of the Company in connection with the proposals. How many votes are required to approve Proposal No. 1? The affirmative vote of a majority of the shares outstanding on the record date of common stock are required to approve granting the Board of Directors the authority, in its sole direction, to approve an amendment to our Certificate of Incorporation to effect a reverse stock split of our issued and outstanding common stock by a ratio of not less than one-for-ten and not more than one-for-two hundred at any time prior to February 19, 2019, with the exact ratio to be set at a whole number within this range as determined by the Board of Directors. Is my vote kept confidential? Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within the Company or to third parties, except: • as necessary to meet applicable legal requirements; • to allow for the tabulation and certification of votes; and • to facilitate a successful proxy solicitation. 5 Occasionally, stockholders provide written comments on their proxy cards, which may be forwarded to the Company’s management and the Board of Directors. Do any of the Company’s officers and directors have any interest in matters to be acted upon? The members of our board of directors and our executive officers do not have any interest in any proposal that is not shared by all other stockholders of the Company. Where do I find the voting instructionsresults of the Special Meeting? We will announce voting results at the Special Meeting and also in our Current Report on Form 8-K, which we anticipate filing within four (4) business days of the Special Meeting. Who can help answer my questions? You can contact our corporate headquarters at 5b Hanagar Street, Hod Hasharon, Israel 4527708, or by phone at +(972) 72-260-0536 or by sending a letter to the Company’s Secretary, with any questions about any proposal described in this proxy statement or how to execute your vote. 6 SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT The following table sets forth information with respect to the beneficial ownership of our common stock as of January 30, 2018 by: • each person known by us to beneficially own more than 5% of our common stock (based solely on our review of SEC filings); • each of our directors; • each of our executive officers; and • all of our directors and executive officers as a group. The percentages of common stock beneficially owned are reported on the basis of regulations of the SEC governing the determination of beneficial ownership of securities. Under the rules of the SEC, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or to direct the voting of the security, or investment power, which includes the power to dispose of or to direct the disposition of, with respect to the security. Except as indicated in the materials you receive directly fromfootnotes to this table, each beneficial owner named in the holdertable below has sole voting and sole investment power with respect to all shares beneficially owned and each person’s address is c/o Wize Pharma, Inc., 5b Hanagar Street, Hod Hasharon, Israel 4527708, unless otherwise indicated. As of record.January 30, 2018 there were 104,412,510 shares of our common stock outstanding. Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | | 5% and Greater Shareholders | | | | | | Rimon Gold Assets Ltd.(1) | | 42,261,137 | | 28.8 | % | Ridge Valley Corporation(2) | | 33,411,037 | | 28.3 | % | Yaakov Zerahia(3) | | 18,588,761 | | 16.8 | % | Simcha Sadan(4) | | 16,388,217 | | 14.8 | % | Shimshon Fisher(5) | | 13,556,874 | | 11.5 | % | Jonathan Rubini(6) | | 12,137,695 | | 11.0 | % | Erez Haver, Adv. in trust for Amir Bramli(7) | | 8,788,912 | | 8.4 | % | Can-Fite BioPharma Ltd.(8) | | 8,563,254 | | 8.2 | % | Erez Haver, Adv. and Yehuda Bramli, Adv., in trust for Avner Arazi(9) | | 6,164,724 | | 5.9 | % | Yossef Peretz(10) | | 5,947,471 | | 5.5 | % | Executive Officers and Directors | | | | | | Ron Mayron | | 630,208 | | * | | Yossi Keret | | — | | — | | Dr. Franck Amouyal | | — | | — | | Joseph Zarzewsky | | — | | — | | Michael Belkin, Ph.D.(11) | | 52,222 | | * | | Or Eisenberg | | — | | — | | Noam Danenberg(12) | | 1,401,937 | | 1.3 | % | Executive Officers and Directors as a Group (7 Persons) | | 2,084,367 | | 2.0 | % |

7 8 PROPOSAL NO. 1 grant the Board of Directors the authority, in its sole direction, to approve an amendment to our Certificate of Incorporation to effect a reverse stock split of our issued and outstanding common stock by a ratio of not less than one-for-tEN and not more than one-for-TWO hundred at any time prior to FEBRUARY 19, 2019, with the exact ratio to be set at a whole number within this range as determined by the Board of Directors Our Board of Directors has approved and is seeking stockholder approval of an amendment to our Certificate of Incorporation to implement the Reverse Stock Split. The amendment to the Company’s Certificate of Incorporation to effect the Reverse Stock Split of our issued and outstanding common stock, if approved by the stockholders, will be deemedsubstantially in the form set forth onAppendix A (subject to have consented to the proposal. Failure to return the enclosed written consent form will have the same effect as a vote against approval of the proposal.

Written consentsany changes required by applicable law). If approved by the stockholder(s) must be executed in exactlyholders of our common stock, the same manner as the name(s) appear(s) on theReverse Stock Split proposal would permit (but not require) our Board of Directors to effect a reverse stock certificates. Ifsplit of our issued and outstanding common stock certificatesat any time prior to which a written consent relates are held of record by two or more joint holders, all such holders must sign the written consent. If a signature isFebruary 19, 2019 by a trustee, executor, administrator, guardian, proxy, attorney-in-fact, officerratio of not less than one-for-ten and not more than one-for-two hundred, with the exact ratio to be set at a corporation or other record holder acting in a fiduciary or representative capacity, such person should so indicate when signing and must submit proper evidence satisfactory to us of such person’s authority so to act. If stock certificates are registered in different names, separate written consents must be executed covering each form of registration.

FOR A WRITTEN CONSENT TO BE VALID, A STOCKHOLDER MUST COMPLETE, SIGN, DATE AND DELIVER THE WRITTEN CONSENT (OR PHOTOCOPY THEREOF) FOR SUCH HOLDER’S SHARES TO THE COMPANY’S LEGAL COUNSEL. SUCH WRITTEN CONSENT MAY BE DELIVERED TO THE COMPANY’S LEGAL COUNSEL BY HAND, MAIL, EMAIL, FACSIMILE OR OVERNIGHT COURIER.

All written consents that are properly completed, signed and delivered to our legal counsel before the Expiration Date (as defined below), subject to extensionwhole number within this range as determined by our Board of Directors in its sole discretion.

In determining a ratio, if any, following the receipt of stockholder approval, our Board of Directors may consider, among other things, factors such as: • the historical trading price and not revoked beforetrading volume of our acceptance of the written consents, will be accepted.common stock;

The term “Expiration Date” means 5:00 p.m. Mountain Time, on July 31, 2013, unless the Requisite Consents are received before such date, in which case this solicitation will expire on the date that such Requisite Consents are obtained, and such earlier date shall be the Expiration Date.

Final results of this solicitation of written consents will be published in a Form 8-K filed with the SEC after the Expiration Date.

Notwithstanding anything to the contrary set forth in this Consent Solicitation Statement, we reserve the right, at any time before the Expiration Date, to amend or terminate the solicitation, or to delay accepting written consents.

If you have any questions about the consent solicitation or how to vote or revoke your written consent, or if you should need additional copies of this Consent Solicitation Statement or voting materials, please contact Ronen Kantor, the Secretary of the Company, at +(972) 39241114.

Revocation of Consents

Written consents may be revoked or withdrawn by the stockholders at any time before 5:00 p.m. Mountain Time on the Expiration Date. To be effective, a written, facsimile, or email revocation or withdrawal of the written consent must be received by our legal counsel before such time and addressed as follows: OphthaliX Inc., Attn: Legal Counsel, 1656 Reunion Avenue, Suite 250, South Jordan, Utah 84095; by email at jamie@vancelaw.us, or by facsimile at (801) 446-8803. A notice of revocation or withdrawal must specify the stockholder’s name and• the number of shares being withdrawn. Afterof our common stock outstanding;

• the Expiration Date, all written consents previously executedthen-prevailing trading price and deliveredtrading volume of our common stock and not revoked will become irrevocable.the anticipated impact of the Reverse Stock Split on the trading market for our common stock;

• the anticipated impact of a particular ratio on our ability to reduce administrative and transactional costs; and

Solicitation of Consents

• prevailing general market and economic conditions.

Our Board of Directors is sending you this Consent Solicitation Statement in connection with its solicitation of consentsreserves the right to approveelect to abandon the Reverse Split. Certain directors, officersStock Split, including any or all proposed reverse stock split ratios, if it determines, in its sole discretion, that the Reverse Stock Split is no longer in the best interests of the Company and employees of our Company may solicit written consents by mail, email, telephone, facsimile or in person. Our company will payits stockholders. Depending on the ratio for the costsReverse Stock Split determined by our Board of solicitation.

Procedure for ImplementingDirectors, no less than ten and no more than two hundred shares of existing common stock, as determined by our Board of Directors, will be combined into one share of common stock. Any fractional shares will be rounded up to the Proposal

next whole number. The Reverse Split would become effective upon (i) the filing by us with the Delaware Secretary of State of a Certificate of Amendmentamendment to theour Certificate of Incorporation reflectingto effect the amendment, pursuant to Section 242 ofReverse Stock Split, if any, will include only the DGCL, and (ii) 20 days have passed since this Consent Solicitation Statement was sent to stockholders.

AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO

EFFECT A REVERSE STOCK SPLIT

A copy of the Certificate of Amendment is attached asAppendix A to this Consent Solicitation Statement.

General

On July 1, 2013, theReverse Stock Split ratio determined by our Board of Directors by a special meeting duly held, approved effecting a reverse stock split within a range of not less than one for three shares (1:3) and not greater than one for six shares (1:6),to be in the discretionbest interests of our stockholders and all of the Company’s Board of Directors. On July 15, 2013,other proposed amendments at different ratios will be abandoned.

Background and Reasons for the Board of Directors, by a special meeting duly held, approved effecting a reverse stock split of one share for four and one-half shares outstanding (1:4.5) (the “Reverse Split”), whereby, as of the Record Date, for every four and one-half shares of Common Stock then owned, each holder of Common Stock shall receive one share of Common Stock.

Purpose for Reverse Split

The primary purposeSplit; Potential Consequences of the Reverse Split is to meet the minimum trading price required for application for listing by the Company on the NYSE MKT LLC (the “Exchange”). The quantitative standards for listing on the Exchange require a minimum market price for our Common Stock of $2.00 or $3.00 per share. At July 11, 2013, the average trading price of our Common Stock as reported by OTC Markets was $1.47 per share, which reflects the average price for our Common Stock since approximately June 3, 2013. Split

The Board of Directors has recommendedbelieves that in order to meet this minimum market price requirement, the Reverse Stock Split is necessary. There is no assurance that even if we establish aadvisable because the expected increase to the market price of $2.00 or $3.00 per share that our application to the Exchange would be successful. There is also no assurance that ifcommon stock as a result of implementing the Reverse Stock Split is effected,expected to improve the marketmarketability and liquidity of our common stock and is expected to encourage interest and trading in our common stock. The Reverse Stock Split could allow a broader range of institutions to invest in our stock (namely, investors that are prohibited from buying stocks whose price thereafter would be at or remain at $2.00 or $3.00 or higher.

We alsois below a certain threshold), potentially increasing the liquidity of our common stock. In particular, we believe that an increase in the per-share pricemany of our Commoncurrent and potential stockholders, who are located in Israel, cannot trade in our common stock when the stock price is below $1.00 per share. The Reverse Stock Split could encourage increased investorhelp increase analyst and broker interest in our Common Stockstock as their policies can discourage them from following or recommending companies with low stock prices. Because of the trading volatility often associated with low-priced stocks, many brokerage firms and possibly promote greater liquidity for our stockholders. We believe that the current low per-share price of our Common Stock has had a negative effect on the marketability of our Common Stock. We believe there are several reasons for this effect. First, many institutional investors view stocks trading at low prices as unduly speculative in naturehave internal policies and as a result, avoidpractices that either prohibit them from investing in such stocks. Second,low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Some of those policies and practices may function to make the processing of trades in

9 low-priced stocks economically unattractive to brokers. Additionally, because the brokers’ commissions on lower-pricedlow-priced stocks generally represent a higher percentage of the stock price than commissions on higher pricedhigher-priced stocks, the current per-shareaverage price per share of our Common Stockcommon stock can result in individual stockholders paying transaction costs (commissions, markups or markdowns) that constituterepresenting a higher percentage of their total share value than would be the case if the share price of our Common Stock were substantially higher. This factor may also limit We would like to eventually apply for listing on the willingnessNASDAQ Capital Market or another national securities exchange. By potentially increasing our stock price, the Reverse Stock Split could potentially increase our minimum bid or share price required for the initial listing requirements for, for example, the NASDAQ Capital Market. Our common stock is currently traded on the OTCQB under the symbol “WIZP.” As of institutional investors to purchaseJanuary 30, 2018, our Common Stock. Third, a variety of policies and practices of brokerage firms discourage individual brokers within those firms from dealing in low-priced stocks. These policies and practices pertain tostock price was $0.14 per share. At the payment of brokers’ commissions and to time-consuming procedures that make the handling of low-priced stocks unattractive to brokers from an economic standpoint. Fourth, many brokerage firms are reluctant to recommend low-priced stocks to their customers. Finally, the analysts at many brokerage firmspresent time, we do not monitorhave any immediate plans or any agreements or understandings to uplist to a national securities exchange. The NASDAQ Capital Market requires, among other items, an initial bid price of least $4.00 per share and following the trading activity or otherwise provide coverageinitial listing (subject to certain exceptions), the maintenance of low-priced stocks.

Risks Associated witha continued price of at least $1.00 per share. Reducing the Reverse Split

Stockholders should note that the effectnumber of the Reverse Split upon the market price for our Common Stock cannot be accurately predicted. In particular, we cannot assure you that prices foroutstanding shares of our Common Stock aftercommon stock should, absent other factors, increase the Reverse Split will be four and one-half times, as applicable, the prices for shares of our Common Stock immediately prior to the Reverse Split. Theper share market price of our Common Stock may also be affected by other factors which may be unrelated tocommon stock, although we cannot provide any assurance that our minimum bid price would remain following the Reverse Stock Split over the minimum bid price requirement of any such stock exchange.

The Company currently does not have any plans, arrangements or understandings, written or oral, to issue any of the numberauthorized but unissued shares that would become available as a result of shares outstanding. Furthermore, even ifthe Reverse Stock Split. In addition to increasing the market price of our Commoncommon stock, the Reverse Stock does riseSplit would also reduce certain of our costs, as discussed below. Accordingly, for these and other reasons discussed below, we believe that effecting the Reverse Stock Split is in the Company’s and our stockholders’ best interests. While reducing the number of outstanding shares of our common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share market price of our common stock, other factors, such as our financial results, market conditions and the market perception of our business may adversely affect the market price of our common stock. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, that the market price of our common stock will increase following the Reverse Stock Split or that the Companymarket price of our common stock will not decrease in the future. Additionally, we cannot assure you that the market price per share of our Commoncommon stock after a Reverse Stock immediatelySplit will increase in proportion to the reduction in the number of shares of our common stock outstanding before the Reverse Stock Split. Accordingly, the total market capitalization of our common stock after the proposed Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split. Procedure for Implementing the Reverse Stock Split The Reverse Stock Split, if approved by our stockholders, would become effective upon the filing (the “Effective Time”) of a certificate of amendment to our Certificate of Incorporation with the Secretary of State of the State of Delaware. The exact timing of the filing of the certificate of amendment that will effect the Reverse Stock Split will be maintained for any perioddetermined by our Board of time. Even if an increased per-share price canDirectors based on its evaluation as to when such action will be maintained,the most advantageous to the Company and our stockholders. In addition, our Board of Directors reserves the right, notwithstanding stockholder approval and without further action by the stockholders, to elect not to proceed with the Reverse Stock Split may not achieveif, at any time prior to filing the desired resultscertificate of amendment to the Company’s Certificate of Incorporation, our Board of Directors, in its sole discretion, determines that have been outlined above. Moreover, because some investors may viewit is no longer in our best interest and the best interests of our stockholders to proceed with the Reverse Split negatively, we cannot assure you thatStock Split. If a certificate of amendment effecting the Reverse Stock Split has not been filed with the Secretary of State of the State of Delaware by the close of business on February 19, 2019, our Board of Directors will not adversely impact the market price of our Common Stock.

We believe thatabandon the Reverse Split may result in greater liquidity for stockholders. However, it is also possible that such liquidity could be adversely affected by the reduced number of shares outstanding after the Reverse Split, particularly if the share price does not increase as a result of the ReverseStock Split.

If the Reverse Split is implemented, some stockholders may consequently own fewer than 100 shares of Common Stock. A purchase or sale of fewer than 100 shares (an “odd lot” transaction) may result in incrementally higher trading costs through certain brokers, particularly “full service” brokers. Therefore, those stockholders who own fewer than 100 shares following the Reverse Split may be required to pay higher transaction costs if they sell their shares in the Company.

Effect of the Reverse Stock Split on RegistrationHolders of Outstanding Common Stock Depending on the ratio for the Reverse Stock Split determined by our Board of Directors, a minimum of ten and Voting Rights

Our Common Stock is currently registered under Section 12(g)a maximum of two hundred shares of existing common stock will be combined into one new share of common stock. The table below shows, based on the 104,412,510 shares of common stock outstanding as of the Securities Exchange Actrecord date,

10 the number of 1934, as amended (the “Exchange Act”), and we are subject to the periodic reporting and other requirements of the Exchange Act. The Reverse Split would not affect the registration of our Common Stock under the Exchange Act.

Proportionate voting rights and other rights of the holders of Common Stock would not be affected by the Reverse Split (other than the treatment of fractional shares as described below). For example, a holder of 1% of the voting power of the outstanding shares of Common Stock immediately prior tocommon stock (excluding Treasury shares) that would result from the effective time of the Reverse Split would continue to hold 1% of the voting power of the outstanding shares of Common Stock after the Reverse Split. Although the Reverse Split would not affect the rights of stockholders or any stockholder’s proportionate equity interest in the Company (subjectlisted hypothetical reverse stock split ratios (without giving effect to the treatment of fractional shares),:

Reverse Stock Split Ratio | | Approximate Number of Outstanding Shares of Common Stock Following the Reverse Stock Split | 1-for-10 | | 10,441,251 | 1-for-20 | | 5,220,625 | 1-for-30 | | 3,480,417 | 1-for-40 | | 2,610,312 | 1-for-50 | | 2,088,250 | 1-for-60 | | 1,740,208 | 1-for-70 | | 1,491,607 | 1-for-80 | | 1,305,156 | 1-for-90 | | 1,160,139 | 1-for-100 | | 1,044,125 | 1-for-150 | | 696,083 | 1-for-200 | | 522,062 |

The actual number of authorized shares of Common Stock would not be reduced and would increase significantly the ability of the Boardissued after giving effect to issue such authorized and unissued shares without further stockholder action. The number of stockholders of record would not be affected by the Reverse Split.

Effect ofStock Split, if implemented, will depend on the Reverse Stock Split on the Authorized but Unissued Shares

ratio that is ultimately determined by our Board of Directors.

The number of authorized but unissued shares of CommonReverse Stock will be increased significantly by the Reverse Split. For example, based on the 46,985,517 shares of Common Stock outstanding on the Record Date and the 100,000,000 shares of Common Stock that are authorized under our Certificate of Incorporation, a Reverse Split would have the effect of increasing the number of authorized but unissued shares of Common Stock from 53,014,483 to approximately 89,558,774. The issuance in the future of such additional authorized shares may have the effect of diluting the earnings per share and book value per share, as well as the stock ownership and voting rights, of the currently outstanding shares of Common Stock. In addition, the effective increase in the number of authorized but unissued shares of Common Stock may be construed as having an anti-takeover effect. Although we are not proposing the Reverse Split for this purpose, the Company could, subject to the Board’s fiduciary duties and applicable law, issue such additional authorized shares to purchasers who might oppose a hostile takeover bid or any efforts to amend or repeal certain provisions of the Certificate of Incorporation or Bylaws. Such a use of these additional authorized shares could render more difficult, or discourage, an attempt to acquire control of the Company through a transaction opposed by the Board. We do not, at this time, have any plans, arrangements or understandings with respect to the increased number of authorized but unissued shares of our Common Stock that will be available following the proposed Reverse Split. Rather, the Reverse Split is primarily for the purposes as described above.

The par value of the Common Stock would remain at $0.001 per share following the effective time of the Reverse Split.

The Company currently has no outstanding issued Preferred Stock.

Effect of the Reverse Split on Issued and Outstanding Shares

After the effective time of the Reverse Split, each holder of Common Stock will own fewer shares of Common Stock. However, the Reverse Split will affect all stockholdersholders of our common stock uniformly and will not affect any stockholder’s percentage ownership interest in the Company, except due to the treatment of fractional shares,that as described below.

The Reverse Stock Split will reduce the total numberbelow in “Fractional Shares,” record holders of issued and outstanding sharescommon stock otherwise entitled to a fractional share as a result of Common Stock by the reverse split ratio determined by the Board within the limits set forth in this proposal. As of the Record Date, the Company had 46,985,517 shares of Common Stock issued and outstanding. The number of issued and outstanding shares of Common Stock after the Reverse Stock Split will be approximately 10,441,226.rounded up to the next whole number. In addition, the Reverse Stock Split will not affect any stockholder’s proportionate voting power (subject to the treatment of fractional shares).

The Reverse Stock Split may result in some stockholders owning “odd lots” of less than 100 shares of common stock. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher than the costs of transactions in “round lots” of even multiples of 100 shares.

EffectAfter the Effective Time, our common stock will have new Committee on Uniform Securities Identification Procedures (CUSIP) numbers, which is a number used to identify our equity securities, and stock certificates with the older CUSIP numbers will need to be exchanged for stock certificates with the new CUSIP numbers by following the procedures described below. Our common stock will continue to be quoted on the OTCQB under the symbol “WIZP”, subject to any decision of our Board of Directors to list our securities on a national securities exchange.

Beneficial Holders of Common Stock (i.e. stockholders who hold in street name) Upon the implementation of the Reverse Stock Split, we intend to treat shares held by stockholders through a bank, broker, custodian, or other nominee in the same manner as registered stockholders whose shares are registered in their names. Banks, brokers, custodians, or other nominees will be instructed to effect the Reverse Stock Split for their beneficial holders holding our common stock in street name. However, these banks, brokers, custodians, or other nominees may have different procedures than registered stockholders for processing the Reverse Stock Split. Stockholders who hold shares of our common stock with a bank, broker, custodian, or other nominee and who have any questions in this regard are encouraged to contact their banks, brokers, custodians or other nominees. Registered “Book-Entry” Holders of Common Stock (i.e. stockholders that are registered on Stock Optionsthe transfer agent’s books and records but do not hold stock certificates)

The Reverse Split would decreaseCertain of our registered holders of common stock may hold some or all of their shares electronically in book-entry form with the transfer agent. These stockholders do not have stock certificates evidencing their ownership of the common stock. They are, however, provided with a statement reflecting the number of shares registered in their accounts.

11 Stockholders who hold shares electronically in book-entry form with the transfer agent will not need to take action (the exchange will be automatic) to receive whole shares of post-Reverse Stock Split common stock, subject to adjustment for treatment of fractional shares. Holders of Certificated Shares of Common Stock available for issuance under the Company’s 2012 Stock Incentive Plan (the “Plan”). The total number of shares of Common Stock currently authorized for issuance but unissued at the Record Date under the Plan is 3,392,385 (prior to giving effect to the Reverse Split). The Reverse Split would have the effect of reducing the shares of Common Stock authorized for issuance under the Plan to approximately 1,088,888. All shares reserved for issuance under the Plan may be used for incentive stock options. The Company also has outstanding stock options to purchase shares of Common Stock. The Reverse Split will effect a reduction in the number of shares of Common Stock issuable upon exercise of such stock options and will effect an increase in the exercise price of such outstanding stock options. For example, a pre-split option to purchase 300 shares of Common Stock with an exercise price of $1.00 per share would be converted post-split into an option to purchase approximately 66 shares of Common Stock with an exercise price of $4.50 per share. In connection with the Reverse Split, the number of shares of Common Stock issuable upon exercise of outstanding stock options will be rounded down to the nearest whole share and no cash payment will be made in respect of such rounding.

Effective Date

The Reverse Split will become effective upon (i) the filing by us with the Delaware Secretary of State of a Certificate of Amendment to the Certificate of Incorporation, reflecting the amendment, pursuant to Section 242 of the DGCL, and (ii) 20 days have passed since this Consent Solicitation Statement was sent to stockholders (the “Effective Date”). On the Effective Date, shares of Common Stock issued and outstanding immediately prior thereto will be, automatically and without any action on the part of the stockholders, combined, converted and changed into new shares of Common Stock.

Exchange of Stock Certificates

Stockholders holding shares of Common Stockour common stock in certificatecertificated form will be sent a transmittal letter by Action Stock Transfer Corp., our transfer agent after the effectiveness of the Reverse Split.Effective Time. The letter of transmittal will contain instructions on how a stockholder should surrender its, his, her or herits certificate(s) representing shares of Common Stock (“Old Certificates”our common stock (the “Old Certificates”) to the transfer agent in exchange for certificates representing the appropriate number of whole shares of post-Reverse Stock Split Common Stock (“New Certificates”common stock (the “New Certificates”). No New Certificates will be issued to a stockholder until such stockholder has surrendered all Old Certificates, together with a properly completed and executed letter of transmittal, to the transfer agent. No stockholder will be required to pay a transfer or other fee to exchange his, her or its Old Certificates for New Certificates registered in the same name.

Upon surrendering all Old Certificates together with a properly completed and executed letter of transmittal, stockholdersCertificates. Stockholders will then receive a New Certificate(s) representing the number of whole shares of Common Stock whichcommon stock that they are entitled as a result of the Reverse Split.

Stock Split, subject to the treatment of fractional shares described below. Until surrendered, we will deem outstanding Old Certificates held by stockholders to be cancelled and only to represent the number of whole shares of post-Reverse Stock Split common stock to which these stockholders are entitled, subject to the treatment of fractional shares. Any Old Certificates submitted for exchange, whether because of a sale, transfer or other disposition of stock, will automatically be exchanged for New Certificates. If an Old Certificate has a restrictive legend on the back of the Old Certificate,Certificate(s), the New Certificate will be issued with the same restrictive legendlegends that isare on the back of the Old Certificate. Any stockholder whose Old Certificate has been lost, destroyed or stolen will be entitled to a New Certificate only after complying with the requirements that the Company and the transfer agent customarily apply in connection with lost, stolen or destroyed certificates.Certificate(s).

Stockholders who hold uncertificated shares, either as direct or beneficial owners, will have their holdings electronically adjusted by the transfer agent (and, for beneficial owners, by their brokers or banks that hold in “street name” for their benefit, as the case may be) to give effect to the Reverse Split.

Upon the Reverse Split, the Company intends to treat shares of Common Stock held by stockholders in “street name,” that is, through a bank, broker or other nominee, in the same manner as stockholders whose shares of Common Stock are registered in their names. Banks, brokers or other nominees will be asked to effect the Reverse Split for their beneficial holders. However, these banks, brokers or other nominees may have different procedures than registered stockholders for processing the Reverse Split. If a stockholder holds shares of Common Stock with a bank, broker or other nominee and has any questions in this regard, the stockholder is encouraged to contact the stockholder’s bank, broker or other nominee.

STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Interest of Certain Persons in the Reverse Split

No one who has been a Company director or executive officer since the beginning of our last fiscal year has any substantial interest, direct or indirect, by security holdings or otherwise, in the proposed Reverse Split that is not shared by all other holders of the Company’s Common Stock.

Dividends and Defaults

Fractional Shares

We havedo not declared any dividends and there are no arrears in dividends. There are also no defaults in principal or interest in respectcurrently intend to the Common Stock.

No Appraisal Rights

Under Delaware law, our stockholders would not be entitled to rights of dissent and appraisal with respect to the Reverse Split.

Effect on Fractional Stockholders

Stockholders will not receiveissue fractional post-reverse stock split shares in connection with the Reverse Split andStock Split. Therefore, we will not be paying any cash to stockholders for anyissue certificates representing fractional shares. In lieu of issuing fractions of shares, from the Reverse Split. Instead, any resulting fractional shares shall be roundedwe will round up to the nearestnext whole number.

Effect of the Reverse Stock Split on any Options, Restricted Stock Awards and Units, Warrants, and Convertible or Exchangeable Securities

Based upon the Reverse Stock Split ratio determined by the Board of Directors, proportionate adjustments are generally required to be made to the per share exercise price and the number of shares issuable upon the exercise or conversion of all outstanding options, warrants, convertible or exchangeable securities (including investment rights) entitling the holders to purchase, exchange for, or convert into, shares of common stock. This would result in approximately the same aggregate price being required to be paid under such options, warrants, convertible or exchangeable securities upon exercise, and approximately the same value of shares of common stock being delivered upon such exercise, exchange or conversion, immediately following the Reverse Stock Split as was the case immediately preceding the Reverse Stock Split. The number of shares deliverable upon settlement or vesting of restricted stock awards, if any, will be similarly adjusted, subject to our treatment of fractional shares. The number of shares reserved for issuance pursuant to these securities will be proportionately based upon the Reverse Stock Split ratio determined by the Board of Directors, subject to our treatment of fractional shares. Accounting Matters The proposed amendment to the Company’s Certificate of Incorporation will not affect the par value of our common stock per share, which will remain $0.001 par value per share. As a result, as of the Effective Time, the total of the stated capital attributable to common stock and the additional paid-in capital account on our balance sheet will not change due to the Reverse Stock Split. Reported per share net income or loss will be higher because there will be fewer shares of common stock outstanding. 12 No Going Private Transaction Notwithstanding the decrease in the number of outstanding shares following the implementation of the Reverse Stock Split, the Board of Directors does not intend for this transaction to be the first step in a “going private transaction” within the meaning of Rule 13e-3 of the Securities Exchange Act of 1934, and the implementation of the proposed reverse stock split will not cause the Company to go private. Certain Federal Income Tax Consequences of the Reverse Stock Split

Circular 230 Notice:

The tax discussion contained in this Consent Solicitation Statement is not in the form of a covered opinion within the meaning of Circular 230 issued by the United States Secretary of the Treasury. Thus, we are required to inform you that you cannot rely upon any discussion contained in this document for the purpose of avoiding U.S. federal tax penalties. The tax summary contained in this document was written to support the promotion or marketing of the transactions or matters described in it. Each taxpayer should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor.

The following is a summary of thedescribes certain material U.S. federal income tax consequences of the proposed Reverse Split. This discussionStock Split to holders of our common stock: Unless otherwise specifically indicated herein, this summary addresses the tax consequences only to a beneficial owner of our common stock that is based on the Internal Revenue Code, the Treasury Regulations promulgated thereunder, judicial opinions, published positionsa citizen or individual resident of the Internal Revenue Service, and all other applicable authorities asUnited States, a corporation organized in or under the laws of the dateUnited States or any state thereof or the District of this document, all of which areColumbia or otherwise subject to change (possibly with retroactive effect)U.S. federal income taxation on a net income basis in respect of our common stock (a “U.S. holder”). A trust may also be a U.S. holder if (1) a U.S. court is able to exercise primary supervision over administration of such trust and one or more U.S. persons have the authority to control all substantial decisions of the trust or (2) it has a valid election in place to be treated as a U.S. person. An estate whose income is subject to U.S. federal income taxation regardless of its source may also be a U.S. holder. This discussionsummary does not describeaddress all of the tax consequences that may be relevant to a holder in lightany particular investor, including tax considerations that arise from rules of his particular circumstancesgeneral application to all taxpayers or to holders subjectcertain classes of taxpayers or that are generally assumed to special rules (such as dealers in securities, financial institutions, insurance companies, tax-exempt organizations, foreign individuals and entities, and persons who acquired their shares as compensation). In addition, thisbe known by investors. This summary is limited to stockholders that hold their shares as capital assets. This discussion also does not address anythe tax consequences arisingto (i) persons that may be subject to special treatment under U.S. federal income tax law, such as banks, insurance companies, thrift institutions, regulated investment companies, real estate investment trusts, tax-exempt organizations, U.S. expatriates, persons subject to the lawsalternative minimum tax, traders in securities that elect to mark to market and dealers in securities or currencies, (ii) persons that hold our common stock as part of any state, locala position in a “straddle” or foreign jurisdiction.as part of a “hedging,” “conversion” or other integrated investment transaction for federal income tax purposes, or (iii) persons that do not hold our common stock as “capital assets” (generally, property held for investment).

If a partnership (or other entity classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our common stock, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the partner and the activities of the partnership. Partnerships that hold our common stock, and partners in such partnerships, should consult their own tax advisors regarding the U.S. federal income tax consequences of the Reverse Stock Split.

ACCORDINGLY, EACH STOCKHOLDER IS STRONGLY URGED TOThis summary is based on the provisions of the Internal Revenue Code of 1986, as amended, U.S. Treasury regulations, administrative rulings and judicial authority, all as in effect as of the date of this proxy statement. Subsequent developments in U.S. federal income tax law, including changes in law or differing interpretations, which may be applied retroactively, could have a material effect on the U.S. federal income tax consequences of the Reverse Stock Split.

PLEASE CONSULT WITH AYOUR OWN TAX ADVISER TO DETERMINEADVISOR REGARDING THE PARTICULARU.S. FEDERAL, STATE, LOCAL, ORAND FOREIGN INCOME ORAND OTHER TAX CONSEQUENCES TO SUCH STOCKHOLDER OF THE REVERSE SPLIT.STOCK SPLIT IN YOUR PARTICULAR CIRCUMSTANCES UNDER THE INTERNAL REVENUE CODE AND THE LAWS OF ANY OTHER TAXING JURISDICTION.

U.S. Holders

NoThe Reverse Stock Split should be treated as a recapitalization for U.S. federal income tax purposes. Therefore, a stockholder generally will not recognize gain or loss should be recognized by a stockholder upon such stockholder’s exchange of pre-Reverseon the Reverse Stock Split, shares for post-Reverse Split shares pursuantexcept to the Reverse Split.extent of cash, if any, received in lieu of a fractional share interest in the post-Reverse Stock Split shares. The aggregate tax basis of the post-Reverse Splitpost-split shares received in the Reverse Split will be equal to the same as the stockholder’s aggregate tax basis inof the pre-Reverse Splitpre-split shares exchanged therefore. The stockholder’stherefore (excluding any portion of the holder’s basis allocated to fractional shares), and the holding period forof the post-Reverse Split post-split

13 shares received will include the holding period during whichof the stockholder heldpre-split shares exchanged. A holder of the pre-Reverse Splitpre-split shares surrendered in the Reverse Split.

The tax treatment of each stockholder may vary depending upon the particular facts and circumstances of such stockholder. Each stockholder is urged to consult with such stockholder’s own tax advisor with respectwho receives cash will generally recognize gain or loss equal to the tax consequencesdifference between the portion of the Reverse Split. Each stockholder should consult with his or her own tax advisor with respect to allbasis of the potential tax consequences to him or her of the Reverse Split.

Accounting Consequences of the Reverse Split

The par value per share of the Common Stock will remain unchanged at $0.001 per share after the Reverse Split. As a result, on the Effective Date of the Reverse Split, allpre-split shares of Common Stock, warrants and options amounts in the financial statements will be adjusted to give retroactive effect to these reverse splits for all periods presented. Consequently, stated capital attributableallocated to the Common Stock will be reducedfractional share interest and additional paid-in-capital will be increased by the amount by which stated capital is reduced. Per share net incomecash received. Such gain or loss will be increased because therea capital gain or loss and will be fewershort term if the pre-split shares of Common Stock outstanding. The Company does not anticipate that any other accounting consequences, including changes to the amount of stock-based compensation expense towere held for one year or less and long term if held more than one year. No gain or loss will be recognized in any period, will ariseby us as a result of the Reverse Stock Split.

No Appraisal Rights

Regulatory Approvals

ThereUnder the Delaware General Corporation Law, our stockholders are no federal or state regulatory requirements that must be compliednot entitled to appraisal rights with or approval that must be obtained in connection with the Reverse Split.

Termination, Abandonment or Amendment of the Reverse Split

We anticipate thatrespect to the Reverse Split, and we will become effective upon (i) the filing by usnot independently provide our stockholders with the Delaware Secretary of Stateany such rights.

Vote Required The affirmative vote of a Certificate of Amendment to the Certificate of Incorporation, reflecting the amendment, pursuant to Section 242majority of the DGCL, and (ii) 20 days have passed since this Consent Solicitation Statement was sent to stockholders (the “Effective Date”). However, at any time beforeshares of common stock outstanding on the Effective Date, the Reverse Split may be abandoned for any reason whatsoever by therecord date. The Board of Directors notwithstandingunanimously recommends a vote FOR the approval of the stockholders.Reverse Stock Split.

SECURITY OWNERSHIPHOUSE HOLDING OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTMATERIALS

The following table sets forth certain information concerning the ownership of our Common Stock as of July 12, 2013, of (i) each person who is known to us to be the beneficial owner of more than five percent of our Common Stock, without regard to any limitations on conversion or exercise of convertible securities or warrants; (ii) all directors and named executive officers; and (iii) our directors and executive officers as a group. The table also sets forth certain information concerning the ownership of ordinary shares of Can-Fite Biopharma Ltd,, an Israeli public company (“Can-Fite”), as of July 12, 2013, by (i) each of our directors and named executive officers, and (ii) our directors and executive officers as a group.

| | | | | Name and Address of Beneficial Owner | OphthaliX Common Stock Amount and Nature of Beneficial Ownership(1) | Percent of Class(1) | Can-Fite Ordinary Shares Amount and Nature of Beneficial Ownership(1) | Percent of Class(1) | Pnina Fishman, Ph.D. Chairman of the Board | 65,551(2) | * | 572,263(3) | 2.87% | | | | | | Ilan Cohn, Ph.D. Director | 0 | -- | 202,532(4) | 1.02% | | | | | | Guy Regev Director | 255,535(5) | * | 52,265(6) | * | | | | | | Roger Kornberg, Ph.D. Director | 117,500(7) | * | 0 | -- | | | | | | Michael Belkin, Ph.D. | 0 | -- | 0 | -- | Director | | | | | | | | | | Barak Singer Chief Executive Officer | 78,310(8) | * | 7,750 | * | | | | | | Itay Weinstein Chief Financial Officer | 31,823(9) | * | 16,000 | * | | | | | | Executive Officers and Directors as a Group (7 Persons) | 548,719 | 1.17 | 850,810 | 4.27% | | | | | | Can-Fite BioPharma Ltd. 10 Bareket Street Kiryat Matalon P.O. Box 7537 Petah-Tikva 49170 Israel | 41,962,048 (10) | 83.24% | -- | -- |

* Less than 1%

(1)This table is based upon information supplied by officers, directors and principal stockholders and is believed to be accurate. Unless otherwise indicated in the footnotes to this table, we believe that eachIn some instances, only one copy of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Beneficial ownershipproxy materials is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of Common Stock subject to options, warrants, or other conversion privileges currently exercisable or convertible, or exercisable or convertible within 60 days of the date of this table, are deemed outstanding for computing the percentage of the person holding such option, warrant, or other convertible instrument but are not deemed outstanding for computing the percentage of any other person. Where more than one person has a beneficial ownership interest in the same shares, the sharing of beneficial ownership of these shares is designated in the footnotes to this table. At July 12, 2013, we had 46,985,517 common shares outstanding and Can-Fite had 14,272,461 ordinary shares outstanding, giving effect to a reverse split effective May 12, 2013.

(2)Includes 21,850 warrants.

(3) Includes 263,433 ordinary shares, 60,000 registered warrants (Series 8) to purchase 2,400 ordinary shares, 90,000 registered warrants (Series 9) to purchase 3,600 ordinary shares and 7,570,761 unregistered options to purchase 302,830 ordinary shares. All such options are vested.(4) Includes 118,447 ordinary shares, 28,000 registered warrants (Series 8) to purchase 1,120 ordinary shares, 42,000 registered warrants (Series 9) to purchase 1,680 ordinary shares and 2,032,136 unregistered options to purchase 81,285 ordinary shares. All such options are vested.(5)Includes 156,225 shares of Common Stock held in a brokerage account.

(6) Includes 24,240 ordinary shares, 24,000 registered warrants (Series 8) to purchase 960 ordinary shares and 36,000 registered warrants (Series 9) to purchase 1,440 ordinary shares, 250,000 registered warrants (Series 10) to purchase 10,000 ordinary shares and 250,000 registered warrants (Series 11) to purchase 10,000 ordinary shares and 140,625 unregistered options to purchase 5,625 ordinary shares.

(7)Represents 117,500 shares of Common Stock issuable upon exercise of vested options.

(8)Represents 78,310 shares of Common Stock issuable upon exercise of vested options.

(9)Represents 31,823 shares of Common Stock issuable upon exercise of vested options.

(10)Includes 3,427,417 shares of Common Stock issuable to Can-Fite upon the exercise of warrants. The beneficial owner of Can-Fite holding 5% or more of Can-Fite’s outstanding ordinary shares is Shaked Global at 8.57%.

CHANGE OF CONTROL

There are no arrangements or understandings, known to us, including any pledge by any person of our securities:

·

The operation of which may at a subsequent date result in a change in control of the Company; or

·

With respect to the election of directors or other matters.

STOCKHOLDERS SHARING AN ADDRESS

The Company will deliver only one Consent Solicitation Statementbeing delivered to multiple stockholders sharing an address, unless the Company haswe have received contrary instructions from one or more of the stockholders. The Company undertakesstockholders to continue to deliver multiple copies. We will deliver promptly, upon writtenoral or oralwritten request, a separate copy of the Consent Solicitation Statementapplicable materials to a stockholder at a shared address to which a single copy of the Consent Solicitation Statement iswas delivered. A stockholder can notify the Company that the stockholder wishesIf you wish to receive a separate copy of the Consent Solicitation Statement by contactingproxy materials you may call us at +(972) 72-260-0536, or send a written request to Wize Pharma, Inc., 5b Hanagar Street, Hod Hasharon, Israel 4527708, attention: Secretary. If you have received only one copy of the Companyproxy materials, and wish to receive a separate copy for each stockholder in the future, you may call us at the telephone number or write us at the address or phone number set forth below. Conversely, if multiplelisted above. Alternatively, stockholders sharing an address who now receive multiple Consent Solicitation Statements and wishcopies of the proxy materials may request delivery of a single copy, also by calling us at the telephone number or writing to receive only one, such stockholders can notify the Companyus at the address or phone number set forth below.listed above.

14

AVAILABILITY OF REPORT ON FORM 10-K

Copies of our Annual Report on Form 10-K for the year ended December 31, 2012, including financial statements and schedules, are available on our website at http://www.ophthalix.com and will be provided upon written request, without charge, to any person whose proxy is being solicited. Written requests should be made to OphthaliX Inc., Attn: Ronen Kantor, Secretary, at 10 Bareket Street, Petach Tikva, Israel 4951778.

ADDITIONALWHERE YOU CAN FIND MORE INFORMATION

The Company is subject to the informational requirements of the Securities Exchange Act of 1934, as amended. Accordingly, we filefiles annual, quarterly and specialcurrent reports, proxy statements and other information with the SEC.Commission. You maycan read and copy any document we filematerials that the Company files with the Commission at the SEC’s public reference roomCommission’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. You can obtain information about the operation of the SEC’s Public Reference Room by calling the Commission at 1-800-SEC-0330. The Commission also maintains a Web site that contains information we file electronically with the Commission, which you can access over the Internet atwww.sec.gov. You should call the SEC at 1-800-SEC-0330 for further informationrely only on the public reference rooms. Our SEC filings will also be available to the public at the SEC’s web site at http://www.sec.gov.

The Company will provide without charge, to each person to whom an Consent Solicitation Statement is delivered, upon writteninformation contained in, or oral request of such person and by first class mail or other equally prompt means within one business day of receipt of such request, a copy of any and all of the information that has been incorporated by reference as an exhibit to, this Proxy Statement. We have not authorized anyone else to provide you with different information. You should not assume that the information in this Consent SolicitationProxy Statement (not including exhibits to the information that is incorporated by reference unlessaccurate as of any date other than January 31, 2018, or such exhibits are specifically incorporated by reference into the information that the Consent Solicitation Statement incorporates). Such requests should be directed to the address and phone number indicated below. This includes information contained in documents filed subsequent to theearlier date on which definitive copies of the Consent Solicitation Statement are sent or given to security holders, up to the date of responding to the request.as is expressly set forth herein.

OTHER BUSINESS